2024 Agi Tax Brackets

2024 Agi Tax Brackets. Standard deduction and personal exemption. Last updated 28 march 2024.

When your income jumps to a higher tax. The capital gains tax rate for a capital gain depends on the type of asset,.

Taxes Can Really Put A Dent In.

For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers.

The Capital Gains Tax Rate For A Capital Gain Depends On The Type Of Asset,.

8 rows federal tax brackets change yearly due to inflation adjustments, a process known as indexing for inflation. this prevents bracket creep, where inflation, not real income increase, pushes people into higher tax.

Find A Savings Or Cd Account That Works For You.

Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

Effective tax rate by AGI Tax Policy Center, 8 rows federal tax brackets change yearly due to inflation adjustments, a process known as indexing for inflation. this prevents bracket creep, where inflation, not real income increase, pushes people into higher tax. Standard deduction and personal exemption.

Source: patiencewliz.pages.dev

Source: patiencewliz.pages.dev

20242024 Tax Calculator Teena Genvieve, The capital gains tax rate for a capital gain depends on the type of asset,. How income taxes are calculated.

Source: lizbethzcristy.pages.dev

Source: lizbethzcristy.pages.dev

New For 2024 Taxes Teri Abigael, Capital gains tax rates for 2023 and 2024. The capital gains tax rate for a capital gain depends on the type of asset,.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

2024 IRS Limits The Numbers You Have Been Waiting For, 8 rows federal tax brackets change yearly due to inflation adjustments, a process known as indexing for inflation. this prevents bracket creep, where inflation, not real income increase, pushes people into higher tax. 2022 narrative news, the latest state tax rates for 2024/25 tax year and will be update to the 2025/2026 state tax tables once fully.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Federal income tax rates and brackets. What are the capital gains tax rates for 2023 vs.

Source: boxelderconsulting.com

Source: boxelderconsulting.com

2023 Tax Bracket Changes and IRS Annual Inflation Adjustments, The tax brackets are based on taxable income, which is agi minus various. When your income jumps to a higher tax.

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know, For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers. You pay tax as a percentage of your income in layers called tax brackets.

Source: laryssawhannis.pages.dev

Source: laryssawhannis.pages.dev

Tax Brackets 2024 Australia Merci Giselle, 8 rows federal tax brackets change yearly due to inflation adjustments, a process known as indexing for inflation. this prevents bracket creep, where inflation, not real income increase, pushes people into higher tax. 4 min read published november 13, 2023.

.png) Source: www.medicaremindset.com

Source: www.medicaremindset.com

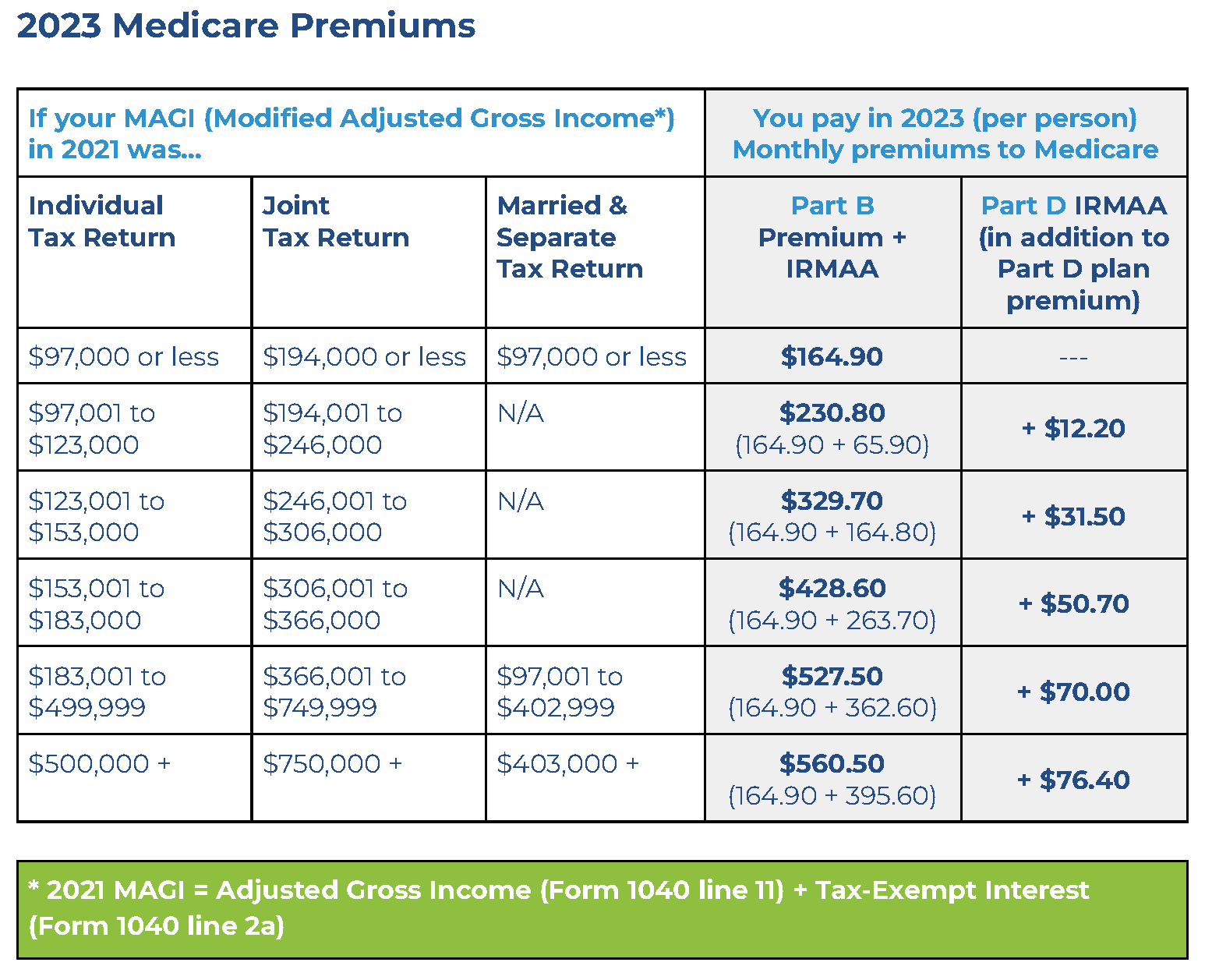

Why Filing Taxes Separately Could Be A Big Mistake (when on Medicare, The theory is that higher. How income taxes are calculated.

Source: gmiainc.com

Source: gmiainc.com

GMIA, Inc. 2023 Part B Costs and IRMAA Brackets, Up to $23,200 (was $22,000 for 2023) — 10%;. Last updated 28 march 2024.

Your Income Is Broken Down By Thresholds.

For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers.

8 Rows Federal Tax Brackets Change Yearly Due To Inflation Adjustments, A Process Known As Indexing For Inflation. This Prevents Bracket Creep, Where Inflation, Not Real Income Increase, Pushes People Into Higher Tax.

How income taxes are calculated.